Easily Find Funds That Fit Your Mandate

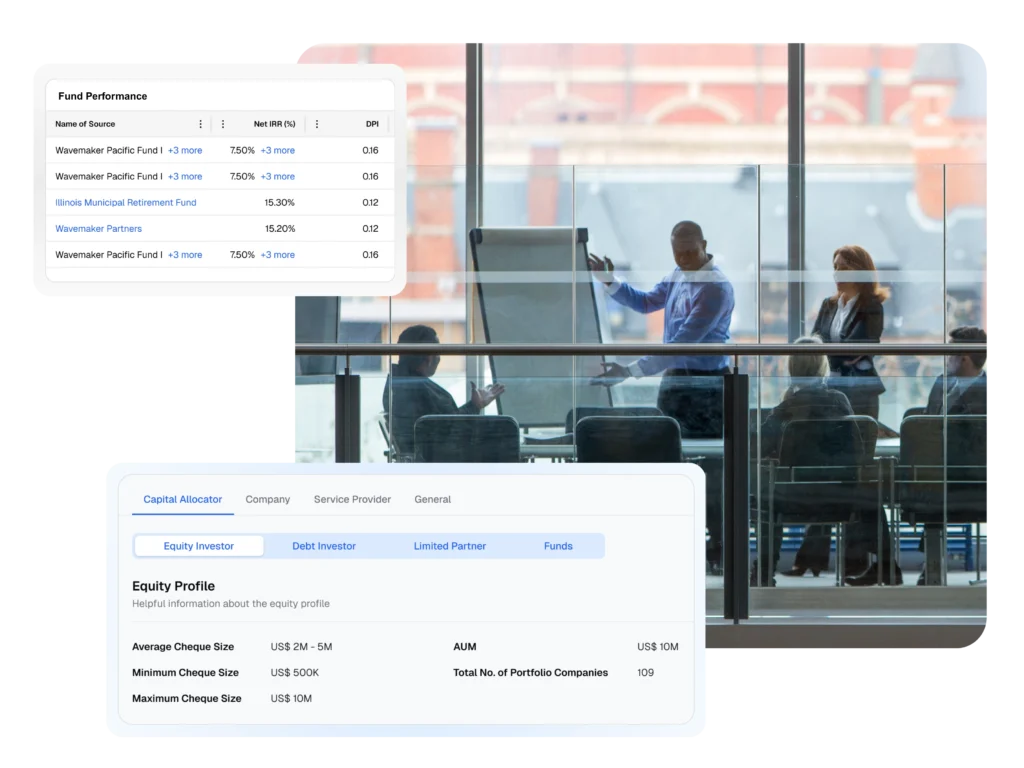

Qualify funds by sector and average cheque size. Get fund-level metrics and historical performance of funds in Southeast Asia, Australia and India.

Verify Fund Managers' Performance

Don’t rely on pitch decks. Compare Net IRR, DPI, TVPI and vintage-year results against regional peers, so you only back managers with proven outcomes.

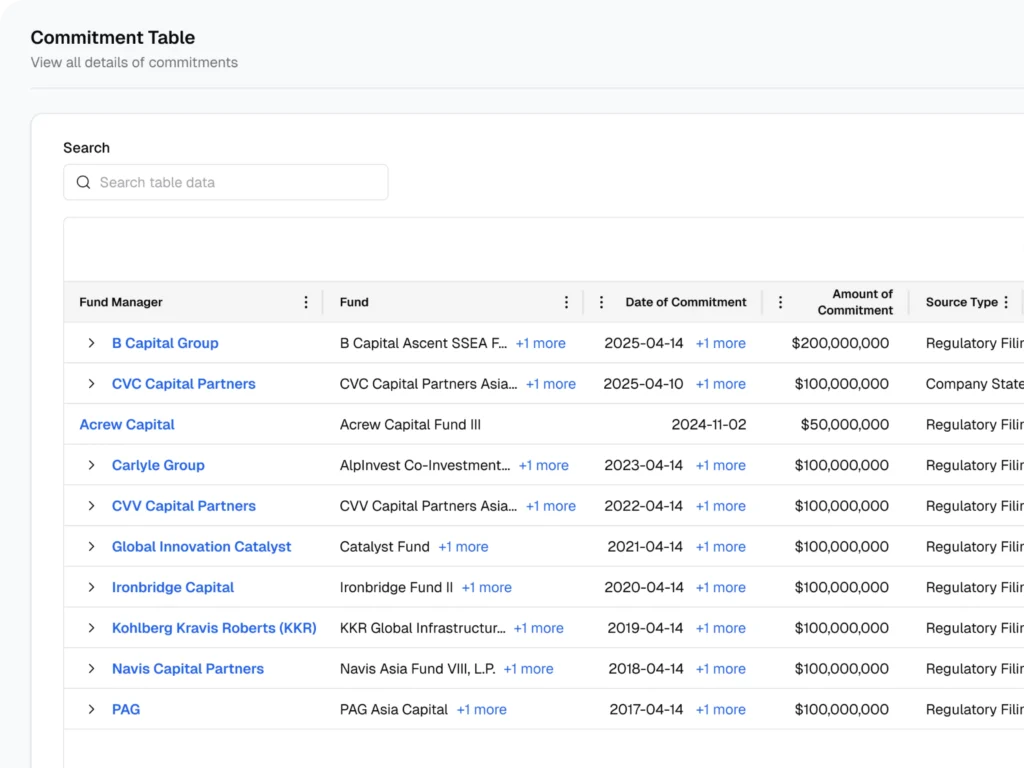

Follow Where Capital Is Flowing

Know who is actually writing cheques, where commitments are clustering, and which LPs co-invest or follow-on, so you know which managers are attracting real capital.

See Exit Pathways

Map possible exits using detailed transaction records, buyer profiles and secondary-market activity to set realistic timing and return expectations.

Benchmark Your Allocations

See fund performance and mandate data across the region so you can benchmark your exposure by sector, stage and vintage and improve portfolio construction.

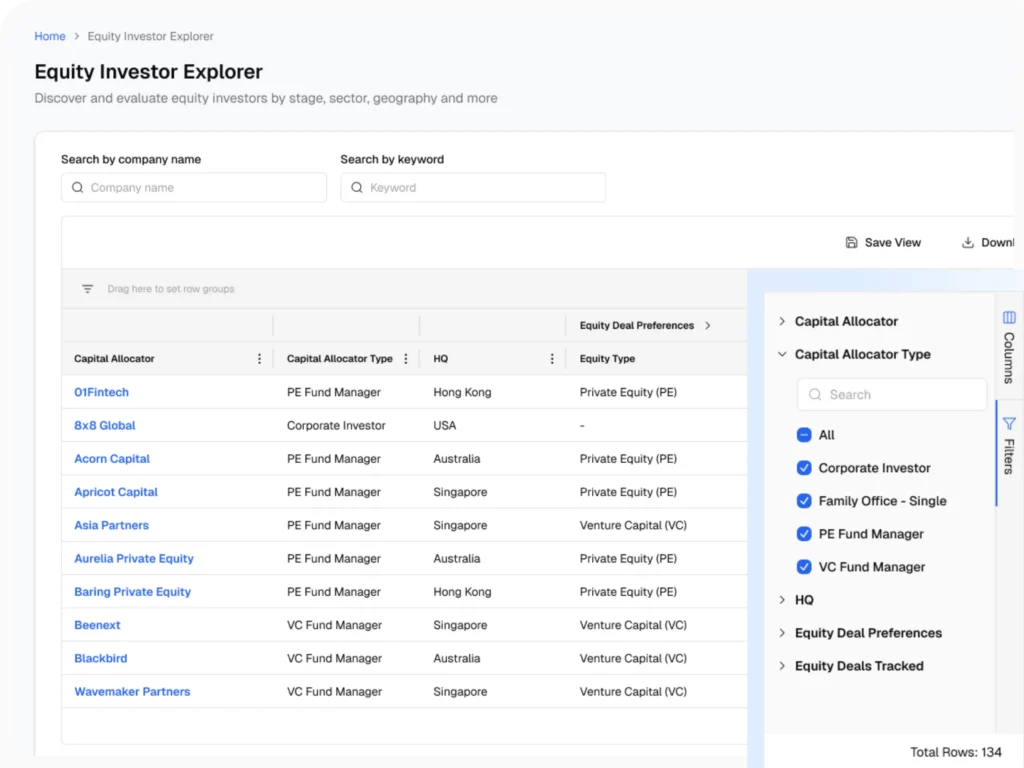

Discover Atlas by Alternatives.pe

Access the largest database of 14,000+ Fund Managers, Limited Partners and Family Offices with interest in Asia

Find top performing funds & managers

View fund profiles and investors’ preferred vs actual investments. Data points include: average cheque sizes, country, themes, industries and deal types etc.

See where other LPs are making commitments

Get the full view of LP profiles that include average cheque sizes, current vs target allocation, investment preferences, commitments and contact details.

Trusted by These Companies

See how other firms use our data to get a

precise view of the market

Alternatives.pe is one of the fastest and most accurate sources of deal data for Australia & New Zealand. It gives us a clear view of how well we're tracking the market, which helps ensure we're showing up for the right founders at the right time, and as early as possible.

Read the case study→

Data Lead

I get an accurate view of the Southeast Asia venture market. It informs our decision making and helps us move faster. Whether I’m evaluating a new investment or helping a founder prep for their next raise, the insights it provides are incredibly valuable.

Read the case study→

Emeritus Partner

The platform is clean, intuitive, and helps us quickly surface relevant market participants in the region, details of capital flows, and showcase transaction insights that complement what we see with other databases and through our own informed research. The filters & up-to-date information on startups are what works best for us.

Head of Operations

How Airtree Uses Data from Alternatives.pe to Strengthen Deal Coverage in Australia & New Zealand